Temporary Website Outage

Contact Us

Loan Calculator

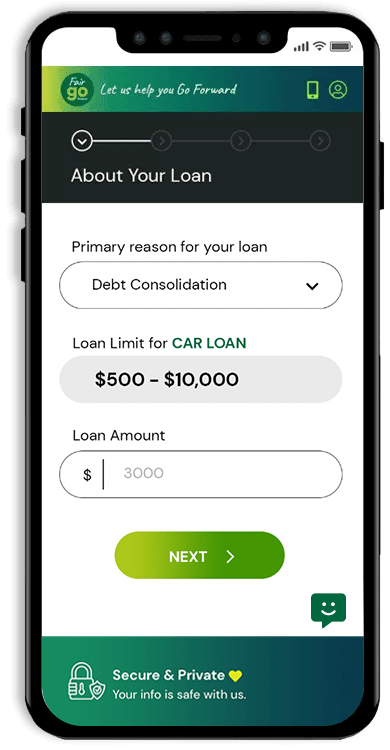

How to get a loan with Fair Go Finance

How to Apply

Our online application should take you no more than 6 minutes to complete. You just need to tell us your income and expenses and then provide some ID and bank account information.

After five quick screens you’ll be done!

With Fair Go Finance, you don’t need to provide any hard copies of your documents because our loan application process is 100% online.

For example, to help you submit your bank statements quickly and easily during the application, we provide you with an online bank statement service called bankstatements.com.au.

This securely accesses 90 days of your bank statements in a read-only format so your funds are completely safe. This service is fast and secure thanks to its 256 bit data encryption.

By providing your bank statements like this, your loan application will be processed in the fastest possible turnaround!

Plus, if your loan is approved there’s no signing required! We’ll send you an SMS message with a unique code that you can enter straight into the screen to accept the offer! At Fair Go Finance our loan process is super quick, easy and paperless!

We use Real Time Funding, which can have your funds transferred to your bank account in under a minute. If your bank participates with the platform called Split Payments, you can expect to see your loan funds in no time!

We understand there can be times during your loan when you’d really like to speak to someone.

That’s where our friendly Customer Experience team come in, and who are happy to speak to you via phone, email or live chat to solve your query.

And if your financial situation ever changes or you start having repayment issues, then our dedicated Customer Care team are also available and ready to help – we pride ourselves on giving you a fair go from start to finish.

Please have a look at our fantastic customer reviews which are a testament to the great customer service we love to provide!

All Fair Go Finance customers receive:

- Excellent customer service

- Free direct debit set up

- Helpful payment reminders

- Flexible repayment options

- Loyalty rewards (for repeat customers)

If all of this sounds great and you’re ready to Go Forward with Us, apply now.

What information do I need to apply for a loan?

| Document type | Examples |

|---|---|

| Identification | Drivers licence number OR medicare card number |

| Bank Statements | 3 months bank statements (i.e. the most recent 90 days). A bank statement service is provided for you to use during the application. |

By supplying all of the above information during the online application you can get the fastest possible loan outcome!

On the odd occasion, there may be a need for you to provide an additional document, such as a utility bill or salary slip.

For these situations, your dedicated lending consultant will be in touch to let you know what you need to do.

If you ever need to email us, our email address is: apply@fairgofinance.com.au

Tips for applying for a loan

To protect your credit rating, avoid applying with multiple lenders because too many credit enquiries on your credit report can negatively impact your credit rating, which does influence your outcome.

Choose the best lender for your situation before applying. Read more about protecting your credit rating here.

We have a dedicated customer service team available to answer any queries you may have. It’s better to discuss any concerns you may have before submitting an application.

Be upfront with your income, identity and finances. The documents you provide confirm this information plus other verification checks that we do. If your loan can’t be approved right now, we’ll explain the reasons why and provide you some suggestions to help you apply in the future.

Try to have the information (listed further above) to support who you are, what you earn and where you live. This is needed before a loan can be approved. If you’re unsure, please contact us, we’re here to help you go forward.

Are you eligible to apply?

- I am 18 years or older

- I have not entered into bankruptcy or part 9 agreement within the last 6 months

- I am willing to provide my Bank Statements online

- My income is not solely from Centrelink